Oregon just hit the geological lottery.

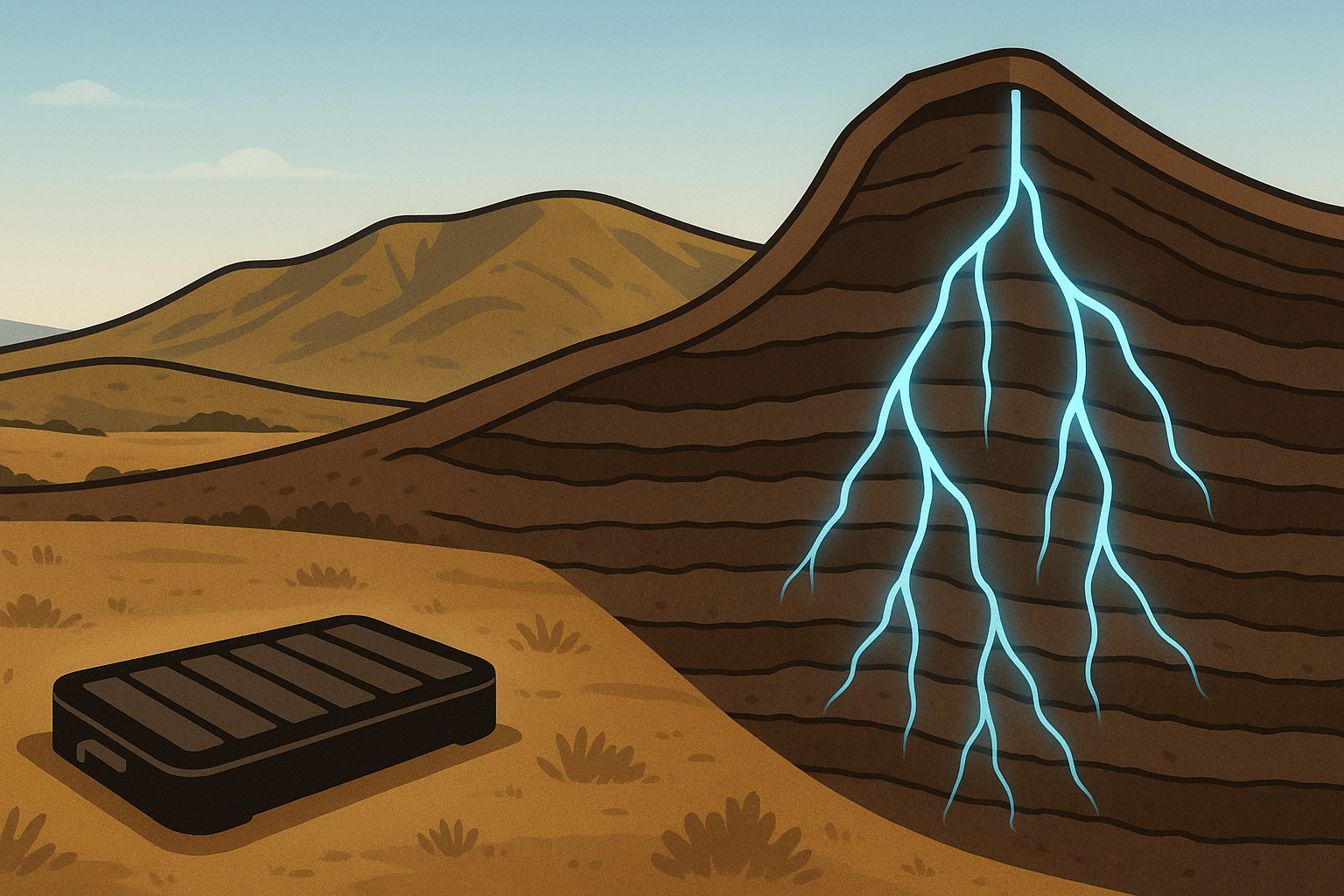

A massive lithium deposit worth approximately $1.5 trillion has been discovered beneath the McDermitt Caldera, buried under layers of volcanic ash that kept this mineral treasure hidden for millennia. It's the kind of discovery that makes geologists weak in the knees and investors reach for their checkbooks.

The timing? Almost suspiciously perfect. As automakers worldwide scramble to secure battery materials for the electric vehicle revolution, America suddenly finds itself sitting on what might be the largest domestic lithium reserve ever identified. The 2.3 million ton deposit could potentially power U.S. battery production for generations—if it can be extracted efficiently.

I've been covering resource markets since the last lithium boom in 2017, and let me tell you, the investor excitement is palpable. But should you rush to buy lithium stocks? That's... complicated.

Here's the thing about major mineral discoveries—they're marathons disguised as sprints. The "announcement-to-production" timeline for lithium mining operations typically stretches years, sometimes a decade or more. Between environmental permits, local opposition (which is practically guaranteed these days), infrastructure development, and processing facilities, we're looking at a long road ahead.

"It's like announcing you've discovered a cure for cancer that won't be available until 2035," a mining analyst told me yesterday. "Fantastic news, but not immediately actionable."

Take Lithium Americas Corp (LAC), which has seen its share price jump on this news. They operate projects in Nevada, practically next door in geological terms, but don't actually own this new Oregon deposit. Their stock is enjoying what I call "proximity momentum"—rising simply because they're in the right neighborhood.

The broader lithium market presents an absolutely fascinating paradox. Long-term demand seems almost guaranteed as transportation electrifies, yet supply is wildly unpredictable. Prices have whipsawed dramatically over the past five years—surging in 2017-18, collapsing in 2019-20, rocketing again in 2021-22, before falling nearly 80% from their peak last year.

Watching lithium prices is like monitoring the heart rate of someone chugging energy drinks while riding a roller coaster.

What's particularly interesting right now? Despite currently depressed spot prices, major automakers are aggressively securing long-term supply contracts. They're not behaving like companies expecting materials to remain cheap and plentiful.

Look, resource investing isn't for the faint of heart. You're essentially placing simultaneous bets on geology, regulatory approval, community relations, management competence, AND commodity cycles. Most investors would rather juggle chainsaws.

For those determined to gain lithium exposure despite these challenges, several approaches make sense:

First, consider established producers with fortress balance sheets like Albemarle or SQM—companies with the financial strength to weather price volatility.

Second, ETFs like LIT spread risk across the entire supply chain. (Though be warned—these often include battery manufacturers and other adjacent industries, diluting pure lithium exposure.)

Third, look at the "picks-and-shovels" plays—companies providing essential services to the lithium industry regardless of which specific project succeeds. During gold rushes, the most reliable profits often went to the folks selling equipment, not the prospectors themselves.

The McDermitt Caldera discovery won't change lithium's near-term supply-demand dynamics. It's more significant for long-term strategic planning than immediate market implications.

There's an old joke in mining circles that still makes me chuckle: "How do you make a small fortune in mining? Start with a large one." Cynical? Perhaps. But it captures the high-risk nature of the business.

Will this Oregon discovery eventually transform America's battery supply chain? Possibly. The resource potential is undeniably massive. But for investors, the question isn't just what's in the ground—it's how quickly, efficiently and profitably it can be extracted.

And that, unfortunately, is where most lithium dreams go to die.