President Trump has kicked the China tariff can down the road. Again.

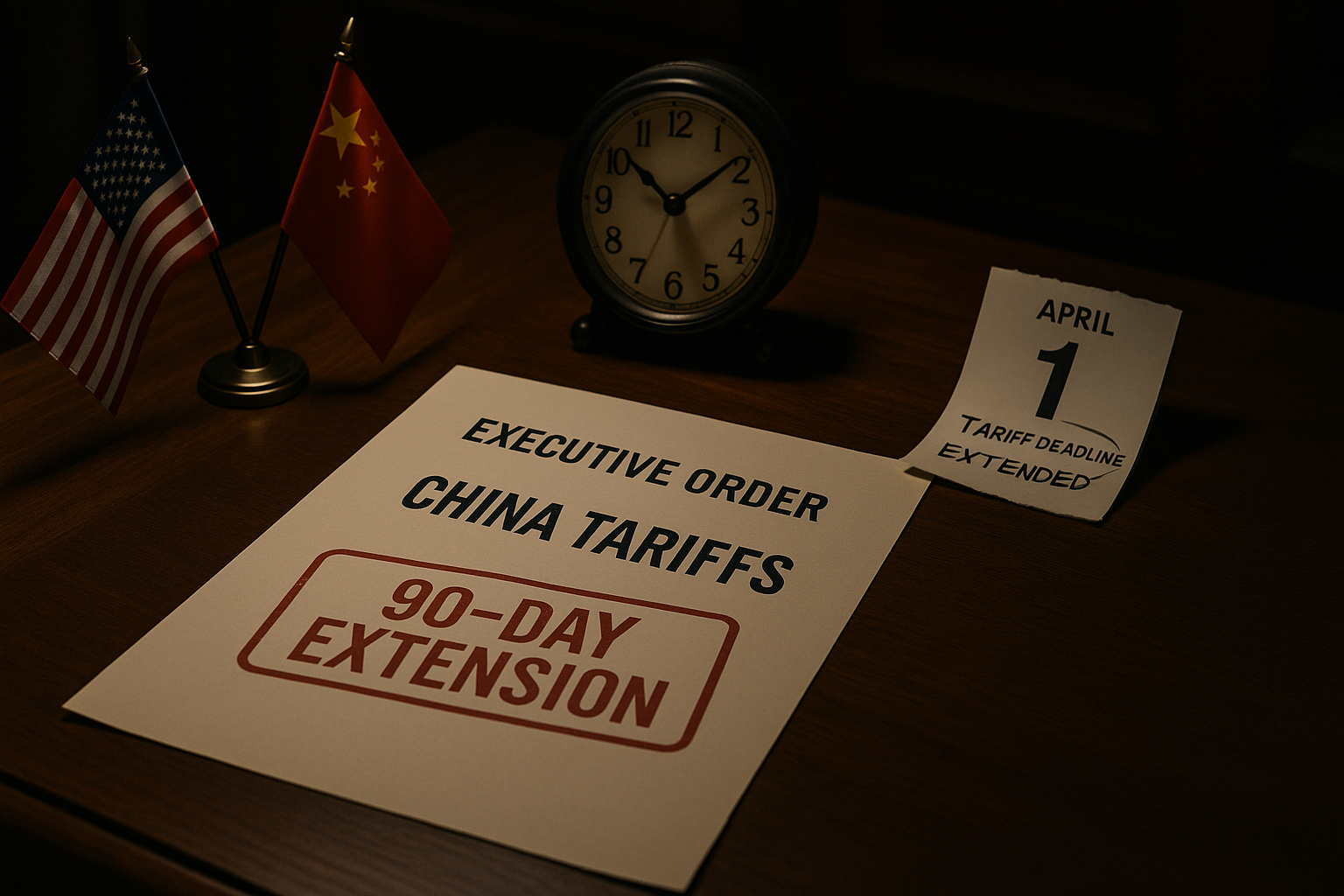

In a move that surprised absolutely no one who's been paying attention, Trump signed an executive order extending the tariff deadline by another 90 days—doing so with his trademark last-minute dramatics just hours before the midnight cutoff.

I've been covering these trade negotiations since they began, and at this point, they've taken on an almost ritualistic quality. Threat, deadline, extension. Rinse and repeat.

The extension follows last month's talks in Stockholm, where—if history is any guide—negotiators probably spent more time enjoying Swedish hospitality than hammering out actual concessions. "Tremendous progress" is the standard line we hear after these meetings, regardless of whether anything substantive happened.

Let's be real for a second. What we're witnessing is political theater masquerading as economic policy.

The choreography has become so predictable that markets have essentially programmed it into their algorithms. First comes the saber-rattling, which triggers a sell-off. Then the deadline approaches and tension builds. Finally, an extension arrives and—boom!—relief rally. As I write this, S&P futures are already climbing.

This creates what market analysts call a "Deadline Discount." (OK, maybe they don't call it that, but they should.) Assets affected by potential tariffs trade lower as the deadline nears, then recover when the inevitable extension materializes. Smart money figured this out long ago.

There's something almost comical about watching this scenario play out repeatedly. It's like attending a magic show where everyone knows how the trick works but pretends to be amazed anyway.

The timing is always calculated for maximum drama—midnight deadlines? C'mon. If trade policy were streaming on Netflix, this would be the season-ending cliffhanger designed to keep viewers coming back. Except the plot twists have gotten pretty stale.

What's interesting (at least to policy nerds like me) is how these "temporary" measures gradually calcify into de facto permanent arrangements. Companies have already spent millions reconfiguring supply chains to adapt to uncertainty. Those changes won't be reversed based on a 90-day reprieve.

I spoke with three manufacturing executives last week who all said the same thing: they've stopped waiting for resolution and instead built tariff costs into their long-term planning. "It's just the cost of doing business now," one told me with a shrug.

The whole situation reminds me of that old saying about how markets can stay irrational longer than you can stay solvent. Maybe in this case, it's more like trade tensions can remain unresolved longer than politicians can remain in office.

Look, I'm not saying trade issues aren't serious business. They absolutely are. The economic consequences are real—especially for farmers and manufacturers caught in the crossfire. But there's a performative aspect to all this that can't be ignored.

Both sides need to appear tough without actually disrupting global trade to the point of economic damage. It's a delicate balancing act, and extending deadlines provides the perfect solution: looking firm while changing nothing.

So what happens next? If you've been following along (and God help you if you have), you already know. Ninety days from now, we'll be right back here, watching the same movie with slightly different scenery. Maybe they'll move the talks to Singapore instead of Stockholm. Perhaps they'll extend by 120 days instead of 90.

The fundamental dynamics won't change until something forces them to—whether that's domestic political pressure, broader economic shifts, or simple exhaustion with the process.

In the meantime, markets will keep pricing in uncertainty while simultaneously betting that the status quo continues. Which, when you think about it, perfectly captures our current economic moment: we're all hedging against risks we suspect will never materialize, but can't quite bring ourselves to ignore.

Welcome to Schrödinger's Trade War, where tariffs are simultaneously imminent and indefinitely postponed.