It turns out high school never really ends—at least not in today's Washington.

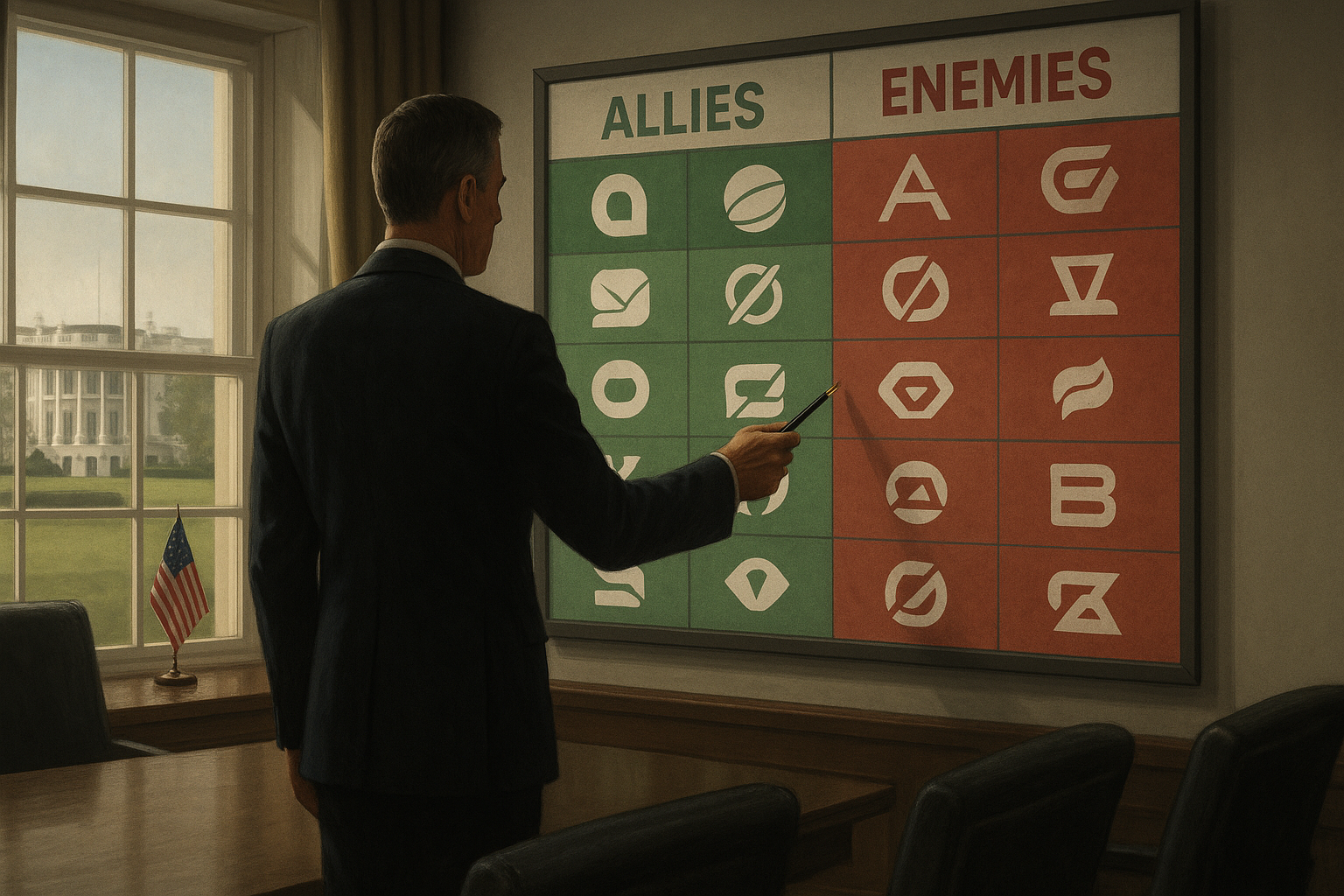

News broke yesterday that the Trump administration has reportedly assembled what might be the most bizarre corporate ranking system since, well... ever: a detailed spreadsheet tracking 533 American companies based on their perceived loyalty to the president himself.

Let me say that again. The White House is keeping tabs—actual, spreadsheet tabs—on which corporations are "allies" and which are "enemies." We've moved from regulatory frameworks to what sounds like a cast list for a political reality show.

I've covered business-government relations for years, and this is new territory. Traditionally, companies worry about regulatory compliance, not whether they've made it onto the presidential equivalent of a burn book.

The whole thing raises obvious questions. What exactly lands a company in the "ally" column? Campaign cash? Factory ribbon-cuttings in swing states? Staying silent when presidential tweets tank your stock? (And yes, I'm old enough to remember when presidential communications came through official channels rather than social media.)

The implications here are fascinating—and troubling. Corporate executives across America are probably frantically texting their government relations teams: "Where do we stand? Are we on the nice list or the naughty list?"

This system represents a fundamental shift in how we conceptualize business-government relations. Look, we've always had various models for this relationship:

- The lobbying approach (throw money at politicians to influence policy)

- The revolving door (hire ex-government officials who know the system)

- Regulatory capture (cozy up to the agencies that oversee you)

But this? This is something different—a "personal fealty" model where corporations are judged not on their compliance with regulations or even their policy positions, but on their personal loyalty to the president.

Which creates a hell of a corporate governance dilemma.

Public company CEOs have fiduciary duties to shareholders, not to political figures. If decisions are being made to curry favor with the administration rather than to create shareholder value... well, that's problematic, to say the least.

(Though I can already hear the counterargument: "In this regulatory environment, presidential favor IS shareholder value.")

The market implications could be substantial. If this list ever leaks—and in Washington, everything eventually leaks—would investors develop trading strategies around it? "The Trump 50" could become a literal investment portfolio. I spoke with several fund managers yesterday who, off the record, admitted they'd absolutely consider such information material.

There's historical precedent for this kind of thing, but you have to look beyond American borders to find it. Russia's oligarch system, various Asian "crony capitalism" models—these all feature versions of this dynamic where political connections determine business success.

What's unusual here is the explicit scorekeeping. Most political-corporate relationship management happens through winks, nods, and unspoken understandings. A literal spreadsheet ranking? That's... almost refreshingly transparent, in a disturbing sort of way.

For corporate leaders, this creates a textbook game theory problem. If your competitors are actively working to get on the administration's good side, can you afford not to play along? Does neutrality effectively equal opposition in this binary framework?

I'm reminded of something Warren Buffett once told me about market bubbles: "When the tide goes out, you discover who's been swimming naked." In this case, when this administration eventually ends—as all do—companies may find themselves exposed for having prioritized political loyalty over sound business judgment.

Meanwhile, I guarantee consulting firms are already drafting pitch decks for their new "Presidential Relationship Management" practice groups. That's capitalism for you—always finding new markets, even in democratic erosion.

Markets do love metrics, after all... even ones that make ESG ratings look straightforward by comparison.