The London Stock Exchange Group is mulling over a shift to round-the-clock trading—a move that would see one of the world's oldest financial institutions keeping its lights on while the rest of London sleeps. It's rather like your distinguished grandfather suddenly announcing he's taking up skateboarding.

This potential change isn't happening in isolation. It's part of a broader race among traditional exchanges to accommodate investors who apparently can't bear the thought of conducting their financial affairs during conventional business hours. What's next? Drive-through IPOs with your morning coffee?

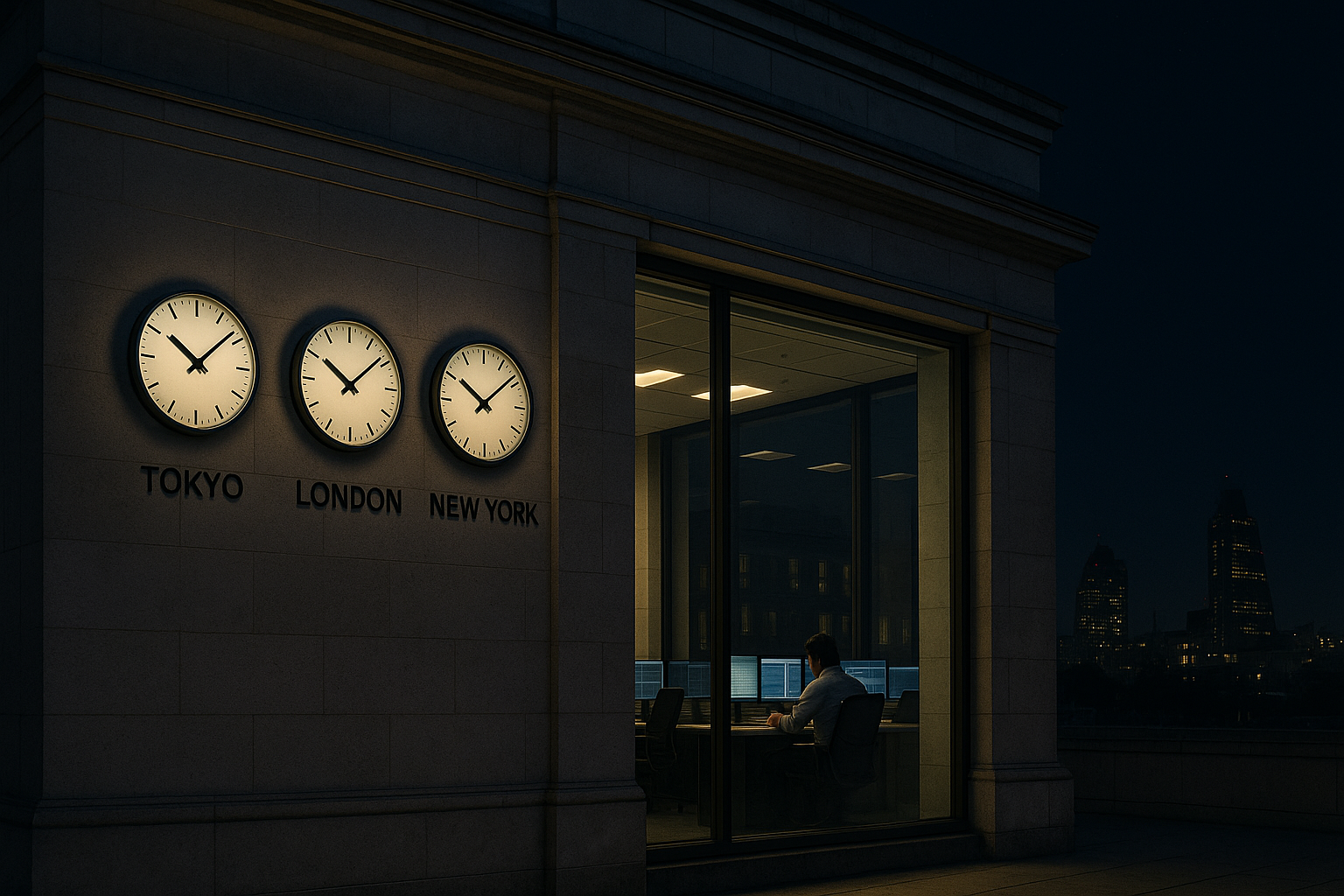

I've been watching financial markets evolve for years, and what strikes me about this particular development isn't just its operational implications—though those are substantial—but what it says about our changing relationship with markets themselves.

Exchanges have historically functioned as temporal gathering places. The opening bell, the closing bell—these weren't just quaint traditions but practical boundaries creating the liquidity pools necessary for effective price discovery. Now we're eagerly dismantling these temporal walls because... well, because someone somewhere wants to panic-sell their tech stocks at 3 AM after reading a disturbing tweet.

Look, there's something deeper happening here. The "convenience premium" has infected financial services just as it has everything else in our lives. Younger investors—particularly the smartphone-wielding crowd that grew up with instant gratification—want their financial services delivered with the same frictionless experience they get from food delivery apps. "I want to buy AMD stock at midnight" feels fundamentally similar to "I want tacos delivered at midnight" in the consumer's mind.

But the convenience comes with costs.

The venerable London Stock Exchange, founded in 1698 at Jonathan's Coffee House (yes, really), now finds itself chasing trends pioneered in the more retail-oriented U.S. market. There's something almost poignant about this institution—which has survived wars, depressions, and the complete transformation of the global economy—now scrambling to accommodate traders who can't be bothered to wait until morning.

Professional fund managers are understandably wary. For them, 24-hour trading introduces nightmarish operational complexities, staffing headaches, and risk management challenges that their systems weren't designed to handle.

"Most fund mandates aren't structured for round-the-clock market monitoring," one London-based portfolio manager told me, requesting anonymity because he wasn't authorized to speak publicly. "And frankly, no one wants to explain to compliance why they made a critical portfolio decision at 2:30 AM while binging 'The Great British Bake Off.'"

The liquidity paradox is perhaps the most fascinating aspect of all this. Extended hours supposedly increase market access, but they also fragment the trading day into periods of vastly different liquidity. The thinner markets of off-hours trading typically lead to wider spreads and more volatile price movements—potentially creating exactly the inefficient price discovery that exchanges were originally designed to prevent.

This reminds me of when U.S. markets extended their trading hours back in the early 2000s. I covered that transition for a financial publication (now defunct—a victim of its own 24-hour news cycle ambitions). The initial excitement quickly gave way to the realization that most serious institutional activity still clustered around the core trading day. The "after hours" sessions became the financial equivalent of being at a club past 2 AM—mostly retail traders making decisions they might regret in the morning.

So why is London doing this?

Existential pressure, that's why. Traditional exchanges are feeling squeezed from alternative trading venues, crypto markets (which never sleep), and the looming threat that trading might eventually migrate to platforms they don't control. The London Stock Exchange, like other venerable institutions, is asking itself the question that keeps executives awake at night: adapt or die?

There are legitimate reasons beyond mere trend-chasing, of course. Global markets are increasingly interconnected, and significant news doesn't respect time zones. When major market-moving events happen in Asia, European investors currently have limited ability to react until their local exchanges open. A 24-hour LSE could bridge these gaps.

But I suspect the real driver is the fear of irrelevance. As trading becomes increasingly digitized and borderless, traditional exchanges risk becoming mere brand names rather than essential infrastructure. By extending hours, they're trying to maintain their centrality in the financial ecosystem.

Will it work? I'm skeptical. The core functions of price discovery and capital formation still seem to benefit from concentrated liquidity within defined timeframes. There's wisdom in the old market structures that shouldn't be discarded merely for the convenience of insomniacs with trading apps.

Then again, many said the same about online trading itself back in the '90s (I was among the skeptics, I must admit). Perhaps in a few years, we'll all wonder how we ever managed with exchanges that had the audacity to close at night.

Until then, I suggest the London Stock Exchange consider a more British approach: extend hours modestly, but ensure there's a proper tea break. Some traditions are worth preserving.