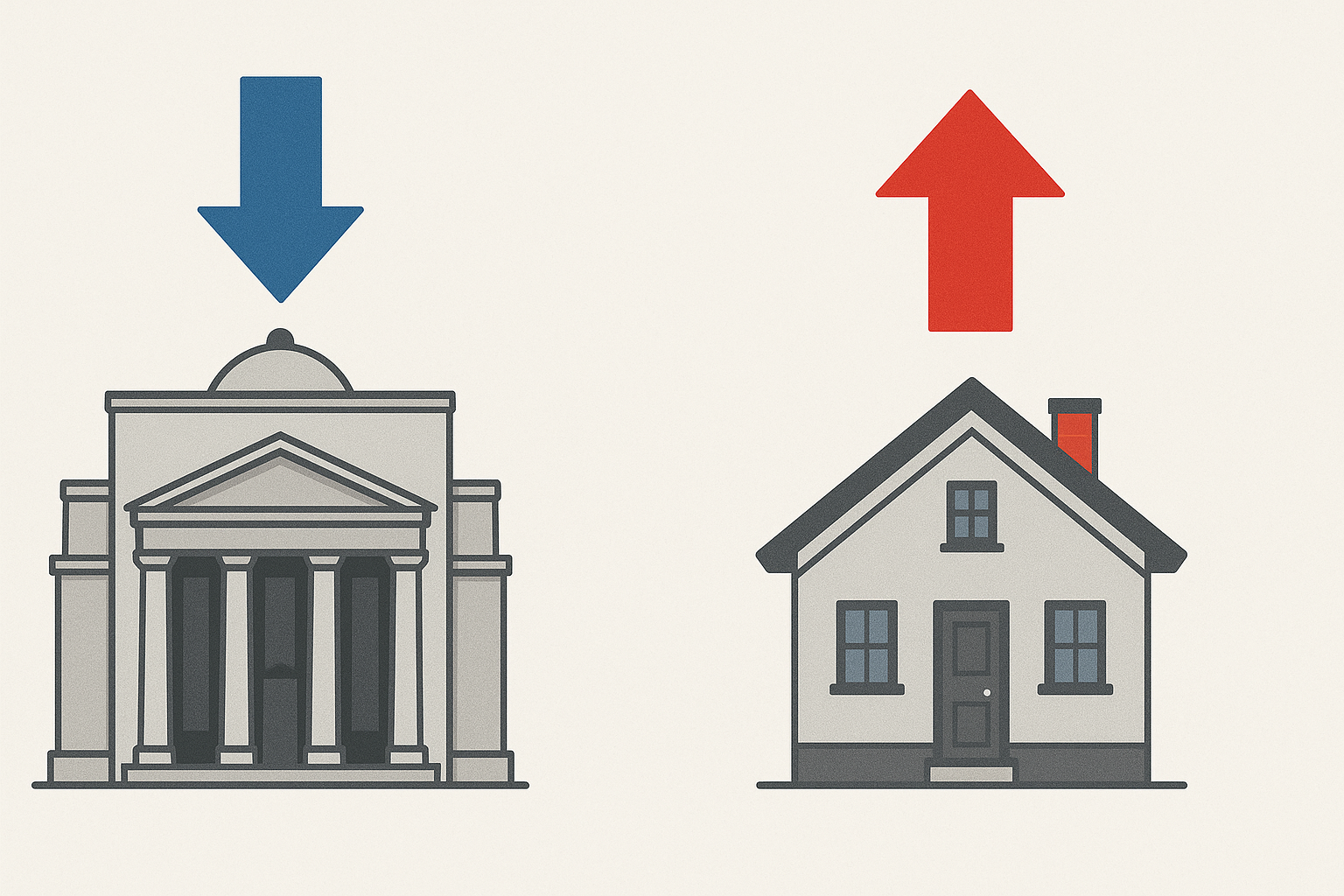

Look, there's this weird thing happening in the financial world right now that's driving homebuyers crazy. The Fed has been slashing rates since September—a full percentage point drop—and yet mortgage rates have... gone up?

Yeah, you read that right. Up, not down.

I've been covering financial markets for years, and my inbox is currently flooded with confused emails from readers. Some are simply puzzled, others are downright suspicious. "Is the system rigged?" one person asked me. Another wondered if "banks are just pocketing the difference." My personal favorite came from a gentleman who's convinced this proves "Jerome Powell is actually a lizard person."

(I can't speak to Powell's potential scale collection, but I can tackle the economic puzzle.)

Short and Long: A Financial Divorce Story

Here's the thing about interest rates that most people don't realize—they're not all created equal. The Fed only directly controls short-term rates, specifically the federal funds rate that banks use for overnight lending. Your mortgage, meanwhile? That's tied to long-term rates, particularly the 10-year Treasury yield.

And these long-term rates don't just mindlessly follow what the Fed does with short-term rates. They're forward-looking, incorporating all sorts of expectations about future inflation, economic growth, and—this is crucial—what investors think the Fed might do next.

Sometimes, these expectations move in exactly the opposite direction of current Fed actions. It's like when your GPS says "turn right" but your gut says the destination is clearly to the left.

Think about it this way: If investors believe the Fed is cutting rates too aggressively and might accidentally reignite inflation, they'll demand higher yields on long-term bonds as compensation. Higher 10-year Treasury yields = higher mortgage rates, even while the Fed is slashing short-term rates.

The Success Problem

There's also this weird catch-22 situation. The Fed cuts rates to stimulate economic activity, right? But if those cuts work really well—if the economy responds with surprising strength—that very success could increase inflation expectations and push long-term rates higher.

It's a bit like how announcing a really effective new diet pill might cause people to eat more cake today. (I've seen this phenomenon firsthand at financial conferences where economists announce "promising disinflation data" right before everyone hits the buffet with renewed enthusiasm.)

The market is also pricing in the possibility that the Fed might need to reverse course if inflation proves stickier than expected. Bond traders are constantly looking around corners—sometimes they see ghosts, sometimes real threats.

Been Here Before

This isn't actually that unusual, though you wouldn't know it from the headlines. During previous Fed easing cycles—like in 2001 and 2007-2008—there were plenty of periods when mortgage rates rose despite Fed cuts.

Having tracked this relationship for over a decade, I can tell you the connection between Fed policy and your mortgage rate is less like a direct mechanical linkage and more like that complicated relationship status on Facebook: "It's complicated."

What's REALLY Going On?

So what's happening now? Several things at once:

- Inflation worries haven't completely disappeared

- Economic data has been surprisingly robust (almost annoyingly so)

- Markets are questioning how many more cuts are actually coming

- The Treasury is issuing mountains of debt, putting upward pressure on yields

- Banks remain cautious about lending standards

The promise that "rate cuts will lower your mortgage" contains an unstated assumption: "all else being equal." But when has anything in economics ever been equal? The system is dynamic, with countless variables responding to each other in real time.

What This Means For Your Wallet

If you've been sitting on the homebuying sidelines waiting for Fed rate cuts to magically lower mortgage rates... you might want to rethink that strategy. The relationship just isn't that straightforward.

Mortgage rates, while higher than the pandemic-era lows (which were frankly unsustainable), remain historically reasonable. I've talked with dozens of first-time homebuyers who keep waiting for that perfect 4% mortgage that their brother-in-law got in 2020, and they might be waiting a very long time.

The best time to make major financial decisions is typically when it makes sense for your personal situation—not when you're trying to time macroeconomic cycles with the precision of a Swiss watch.

And if someone guarantees that more Fed cuts will definitely lower mortgage rates this time around? Well... ask them to put that in writing, along with their explanation of why the last 100 basis points didn't do the trick.

Markets have a funny way of humbling even the most confident forecasters. Trust me on this one—I've got the embarrassing prediction record to prove it.