In the semiconductor industry, where flashy AI chip announcements grab headlines and TSMC's nanometer progress gets all the attention, the real money often hides in the technical weeds. And that's exactly where STMicroelectronics might be cultivating its next competitive advantage.

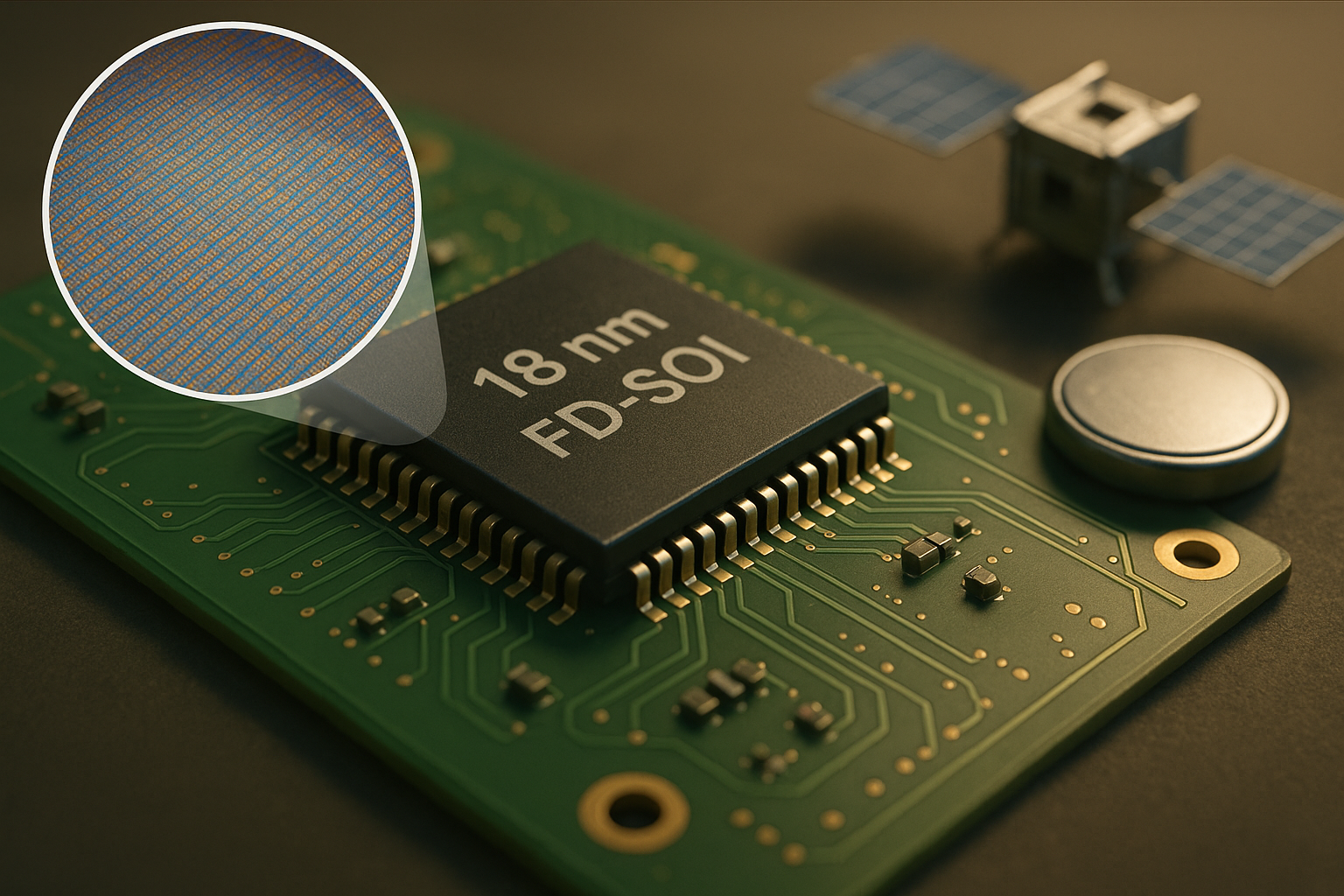

Industry chatter among chip design insiders suggests STM has quietly perfected something most investors would find mind-numbingly boring: phase-change memory technology on their 18nm FD-SOI process. Yawn, right?

Wrong.

This embedded non-volatile memory implementation reportedly delivers area advantages that have competitors like NXP, Infineon, and Texas Instruments scrambling. And in semiconductor manufacturing, space equals money—pure and simple.

Look, I've been tracking memory technology developments for years, and a 40% area reduction for 4MB of non-volatile memory isn't just an improvement—it's practically a revolution in an industry that pops champagne over 10% gains. That's the difference between evolutionary progress and "oh crap, how did they do that?" territory.

The advantages don't stop there. STM's solution apparently operates with 3V programming capability, eliminating the need for charge pumps (those annoying little voltage converters that eat up precious die space) when running on coin cell batteries. For IoT devices and other small-powered applications, that's a game-changer.

Then there's the radiation hardening aspect. This might seem niche unless you've spent time (as I have) talking to aerospace and defense contractors who'll pay serious premiums for components that won't fail when cosmic rays decide to party-crash their satellites. These high-reliability markets aren't just profitable—they're sticky, with customers who hate changing suppliers once they've qualified a component.

I call this the "hidden moat" phenomenon. While Wall Street analysts fixate on quarterly earnings and gross margins, they often miss the technical underpinnings that actually drive those numbers. Nobody's asking about PCM technology on earnings calls, but they probably should be.

So why hasn't STM's stock reflected this potential advantage? The shares are up a modest 14% over the past year—practically standing still compared to the Philadelphia Semiconductor Index's 70% surge.

Perhaps because advantages like these take time to translate into market share gains. Or maybe because manufacturing scale-up is the semiconductor equivalent of threading a needle while riding a roller coaster. Having brilliant technology in the lab is one thing; producing millions of chips with consistent yields is quite another.

(And let's not forget that NXP, Infineon, and TI employ some pretty smart cookies themselves—they won't be sitting idle while STM eats their lunch.)

But here's what intrigues me: while investors frantically chase anything with "AI" in the press release, they might be missing this unsexy but potentially lucrative development at STM. The company serves massive markets in automotive and industrial microcontrollers—areas where reliable, efficient memory technology matters enormously.

Sometimes in semiconductors, the biggest opportunities aren't in the splashy consumer-facing products. Sometimes they're buried in the spec sheets, in the mundane details of how efficiently a company can store ones and zeros.

And in this case, STM might have figured out how to do it 40% better than everyone else. In the chip business, that's not just technical bragging rights—that's money in the bank.