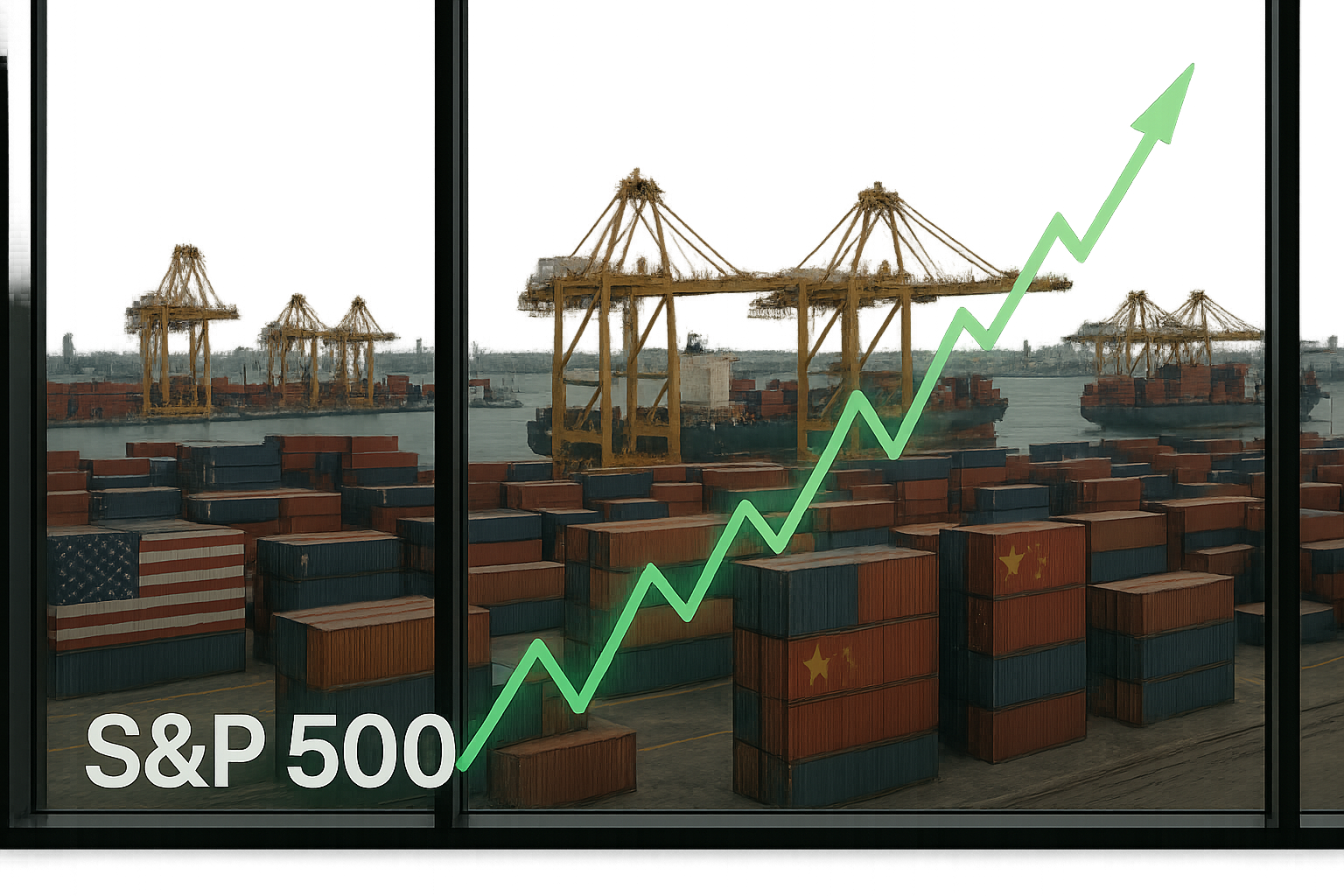

The S&P 500 inched up 0.3% yesterday to close at 5,821, showing remarkable resilience in the face of escalating trade tensions and mixed economic signals. The benchmark index has now recovered all of its losses from the early July selloff and sits just 0.8% below its all-time high.

What's particularly impressive is how the market has shrugged off concerns about potential new tariffs on Chinese goods. The Biden administration has set an August 10 deadline for progress in trade talks, after which additional tariffs could be imposed on various Chinese imports.

"The market seems to be pricing in a negotiated solution rather than a full-blown trade war," noted Sarah Jenkins, chief investment officer at Pinnacle Advisors. "But there's definitely nervousness beneath the surface."

That nervousness was evident in yesterday's trading patterns - defensive sectors like utilities and consumer staples outperformed, while small-caps lagged. The VIX "fear index" also ticked up slightly to 16.8, though it remains well below panic levels.

Economic data released yesterday painted a somewhat confusing picture. The July ISM Manufacturing index came in at 49.1, slightly below the 49.5 consensus and still in contraction territory. But construction spending rose 0.3% month-over-month, exceeding expectations.

In my experience covering markets, this kind of mixed data often leads to choppy trading as investors try to discern the bigger trend. For now, strong earnings from companies like Apple seem to be outweighing macroeconomic concerns - but that balance could shift quickly if trade tensions escalate further.