The financial world has been buzzing lately with that dreaded R-word—recession. And let's be honest, it brings to mind that classic Wall Street quip about economists predicting "nine of the last five recessions." Pretty accurate, if you ask me.

But when you're sitting on a million-dollar tech portfolio? Those recession whispers hit different.

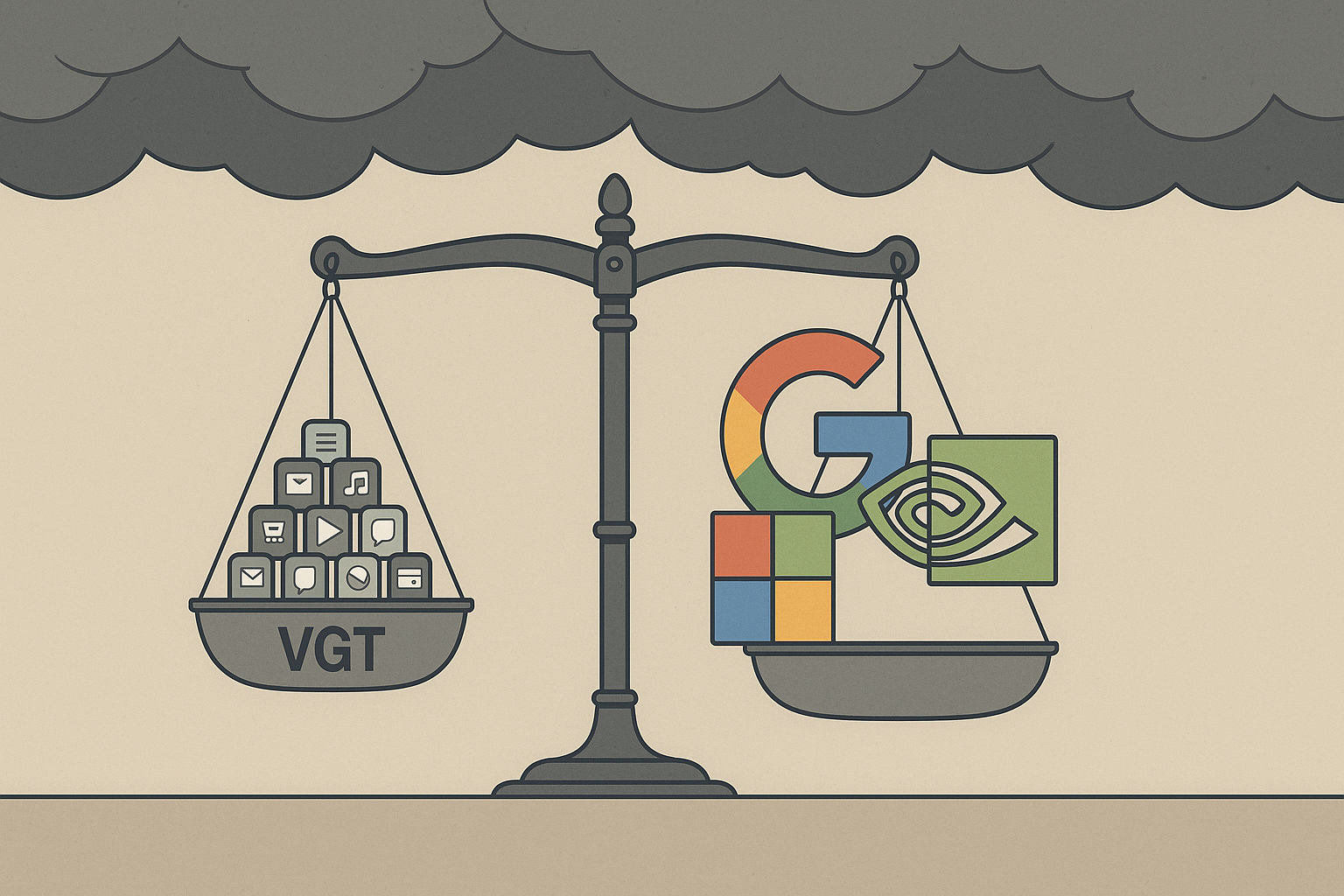

A reader recently reached out with what I'd call a classic investor's dilemma: ditch their broadly diversified Vanguard Information Technology ETF (VGT) holdings for a concentrated bet on three tech darlings—Google, Microsoft, and Nvidia. Their thinking? These titans might weather the coming economic storm better than the broader tech sector.

Look, I completely understand the impulse. When dark economic clouds gather, the urge to DO SOMETHING—anything—becomes almost primal. It's human nature. We see trouble coming and want to rearrange the furniture before the storm hits.

But is breaking up with your diversified ETF really the smart move here?

VGT currently holds about 320 technology companies, with its top ten positions making up roughly 65% of the portfolio. And here's the kicker—MSFT, NVDA, and Google (or Alphabet, if we're being corporate about it) already rank among its largest holdings. So we're not really asking "should I own these companies?" but rather "should I concentrate my bet even further?"

There's some logic to concentration, I'll admit. These three companies have built formidable moats. Microsoft's recurring enterprise contracts provide predictable cash flow. Nvidia basically owns the AI chip market (I've visited their campus—the confidence there is palpable). And Google? Well, even when marketing budgets get slashed, those search ads remain the last dollars cut.

But—and this is crucial—there's a world of difference between identifying strong businesses and timing the market successfully.

I've covered financial markets for nearly two decades, and if there's one lesson that keeps getting reinforced, it's this: the market has an almost perverse delight in humbling even the smartest investors. Remember 2008? Everyone thought they knew which banks would survive. How'd that work out? Or early 2020, when "pandemic-proof" stocks were all the rage? Markets rarely break the way we expect.

Your question contains an implicit assumption that's worth examining: that you can predict both WHEN a recession will hit AND HOW specific stocks will respond. That's... ambitious, to put it kindly. It's a double-layer prediction cake with extra hubris frosting (and I say that as someone who's made plenty of failed predictions myself).

Historical downturns offer sobering lessons. During the 2000-2002 tech implosion, the most beloved companies often fell hardest. In 2008, seemingly recession-resistant businesses still took brutal hits. During the COVID crash, tech initially tanked before staging a comeback that nobody—and I mean absolutely nobody—predicted accurately in real time.

What about VGT itself? By holding this ETF, you're getting those three favorites plus hundreds of others in varying proportions. This includes smaller tech firms that might actually benefit from economic contraction (as larger competitors pull back on innovation spending), as well as established players with defensive characteristics you might be overlooking.

The irony? By trying to reduce risk through selecting "safer" individual stocks, you're actually ramping up your risk profile substantially. If you're wrong about any single company—or if the market simply disagrees with your thesis for an extended period—your performance could suffer dramatically.

A hybrid approach might make sense. Maintain a substantial core position in VGT while allocating a smaller portion to your highest-conviction individual names. This preserves diversification while still letting you express specific market views. Think of it as ordering the tasting menu but also getting that side dish you can't live without.

There's also the psychological element we can't ignore. If you're genuinely concerned about preserving capital during a recession, ask yourself honestly: will you actually sleep better with all your eggs in three baskets rather than 320? When those three stocks have their inevitable bad days (and trust me, they will), will you maintain conviction, or will you panic into another round of ill-timed trades?

I've seen it countless times. Markets eventually make fools of us all. The difference between successful investors and everyone else? It's often just who manages to minimize the self-inflicted damage of reacting to short-term fears.

My take? If market anxiety is keeping you up at night, consider reducing your overall equity exposure rather than concentrating it. But if you're committed to riding out market turbulence, the diversification within VGT provides a more resilient foundation than a three-stock portfolio—no matter how promising those individual companies might seem.

Besides, if a recession were truly "certain," we'd all be better off stockpiling canned goods and ammunition rather than rearranging our tech portfolios. And that's precisely why it probably isn't.