The longtime love story between global pension funds and American markets is hitting a rough patch. It's not quite a dramatic breakup with thrown dishes and divided friend groups—more like that uncomfortable phase where one partner starts mentioning "needing space" while browsing dating apps.

La Caisse de dépôt et placement du Québec, that massive $360 billion Canadian pension fund (basically Canada's piggy bank), just confirmed what market insiders have been whispering about at cocktail parties. Its CEO Charles Emond has essentially announced they're seeing other markets now.

"We're not dumping America entirely," seems to be the message. "But we're definitely exploring our options."

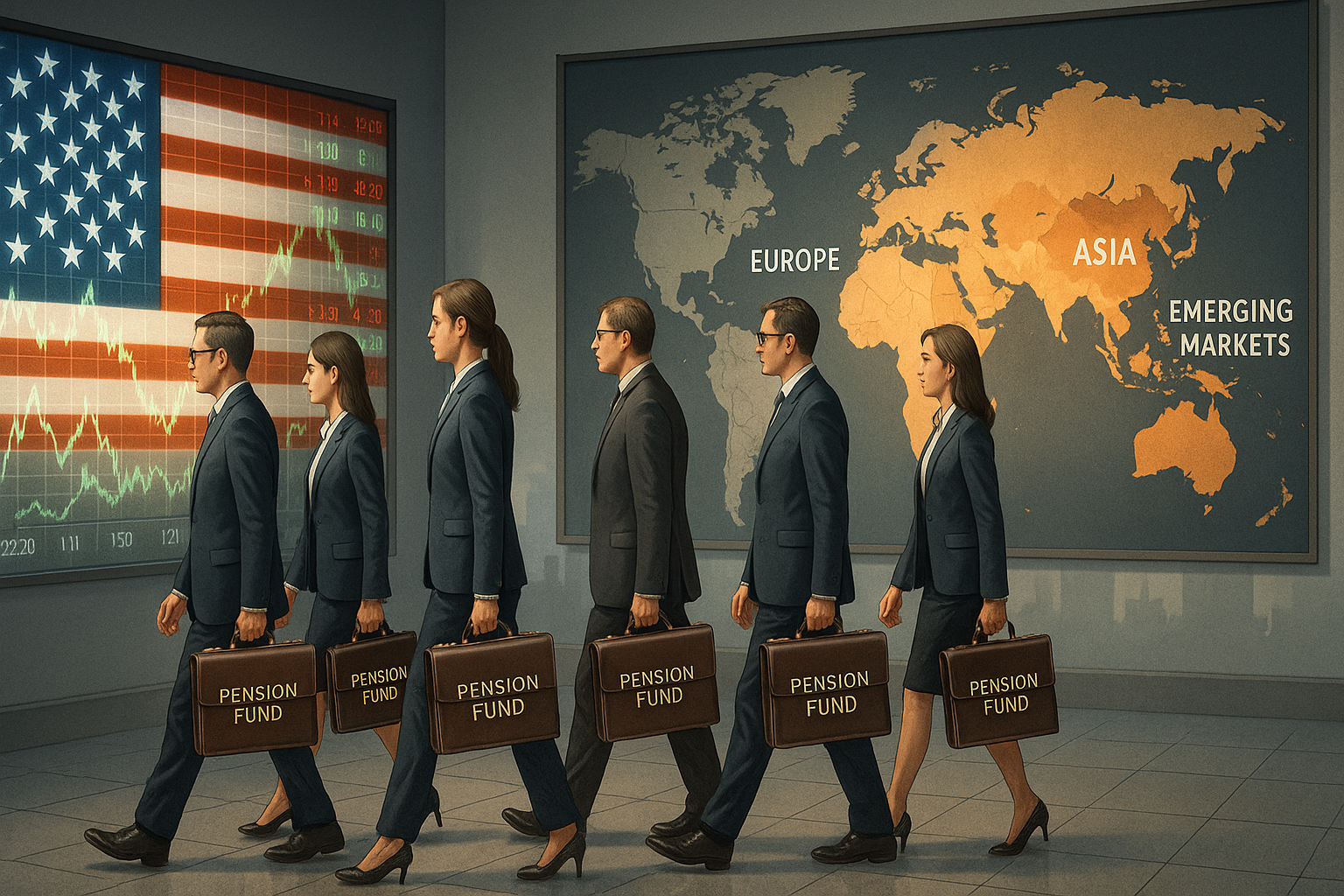

What's particularly telling? Emond says this isn't just a Canadian thing. His pension fund buddies around the world are making the same moves, quietly shifting billions away from U.S. equities while maintaining polite smiles at investment conferences.

The timing couldn't be more ironic.

Just as certain political voices are trumpeting America's economic exceptionalism—look at how we're attracting global capital!—that very capital is tiptoeing toward the exit signs. It's like bragging about your restaurant's popularity while the health inspector posts a closure notice on your window.

Reading the Warning Signs

Why the sudden urge to diversify? The reasons stack up like red flags at a relationship counselor's office.

There's the political meddling in economic data (remember that labor statistics chief who suddenly found himself unemployed?). The mounting pressure on poor Jerome Powell at the Fed. A national debt that's expanding faster than my waistline during lockdown. And let's not forget those protectionist trade policies that could slice corporate profits thinner than the complimentary cheese at a budget wine tasting.

I've been covering institutional investors for years, and let me tell you—when pension funds move, markets eventually follow. These aren't your daytrading Reddit warriors. These are the grown-ups in the room, the players with multi-decade horizons and research departments bigger than most hedge funds.

What's fascinating is the gap between these professional moves and what retail investors are doing. While everyday Americans keep piling into tech stocks and AI plays (can't blame them, given the returns), the professionals managing retirement savings for millions are quietly backing toward the door.

We've seen this pattern before. The big institutions typically move first—not because they're necessarily smarter (though their comp packages certainly suggest they think so), but because their investment process forces them to take a more clinical view of risk-reward scenarios.

Slow Motion Exodus

Now, nobody's saying U.S. markets are about to crash. These allocation shifts happen gradually—more like continental drift than earthquake. But direction matters in investing. When former buyers become sellers, even at the margins, the market dynamics fundamentally change.

So where's all this money going instead? That's the billion-dollar question. Some pension funds are increasing allocations to emerging markets. Others are diving deeper into European equities. Private credit is having a moment. Real assets too.

Each fund will chart its own course, but collectively, these decisions will reshape global capital flows in ways that'll impact everything from currency markets to that rental property you've been thinking about buying.

For regular investors—you know, those of us without hundreds of billions to shuffle around—there's a lesson here. When the big fish start swimming in a different direction, it's worth at least asking why. That doesn't mean panic-selling your S&P 500 index fund, but maybe... diversification deserves another look?

The whole situation drips with irony. Just as "America First" investment strategies are being championed most loudly, the patient capital—the money that thinks in decades, not quarters—is quietly betting on a more global approach.

Markets, as I've learned covering them for fifteen years, have an absolutely wicked sense of humor.

Look, the U.S. market could continue its winning streak. It's defied the doubters for years now. But when the folks responsible for funding retirements decades into the future start hedging their American bets... well, maybe check that your own portfolio isn't putting all its eggs in one red, white, and blue basket.

Just a thought.