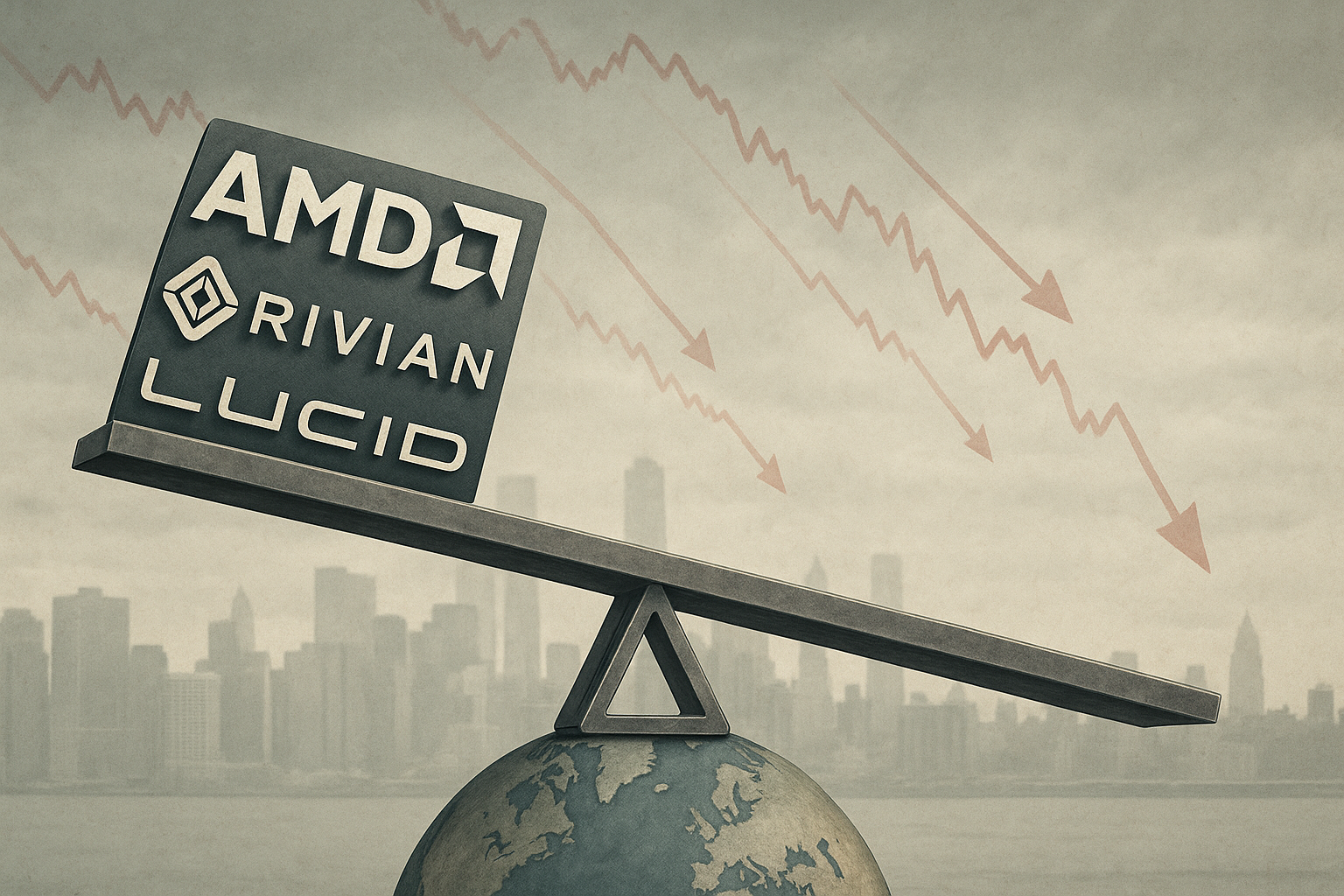

Wall Street took a beating yesterday as tech heavyweights AMD, Rivian, and Lucid disappointed investors with their quarterly numbers. The market's reaction highlights just how fragile investor confidence has become in today's uncertain economic climate.

The global economy seems caught between promise and peril right now. Tech stocks led the plunge, sending ripples across markets worldwide - a stark reminder that we're all in this together, whether we like it or not.

AMD's numbers weren't terrible on the surface - revenue actually climbed about $300 million - but they merely met expectations at 48 cents per share. In today's market, meeting expectations just doesn't cut it anymore. Meanwhile, Rivian and Lucid are still struggling with production issues at a time when consumer spending patterns are shifting dramatically.

The fallout wasn't confined to U.S. markets. Asian exchanges (particularly in Taiwan and South Korea) took a hit as investors worried about tech export demand. European markets weren't spared either, especially in sectors with close ties to American tech.

"The tech sector has become something of a canary in the coal mine for global economic health," noted economist Dr. Jane Lee in a conversation I had with her yesterday. "These earnings results are raising red flags for investors everywhere."

Market analyst John Smith put it more bluntly: "Investors are freaking out about geopolitical risks, and tech's central role in the economy just amplifies those concerns."

Several factors are driving the tech sector's troubles. The ongoing U.S.-China tensions have created supply chain nightmares that just won't go away. And let's be honest - consumer preferences are evolving faster than some companies can adapt, while regulators worldwide seem determined to make life difficult for tech giants.

Looking ahead, investors should keep a close eye on policy developments (especially around trade and tech regulation) and how consumer behavior continues to evolve post-pandemic.

In my experience, times like these call for a balanced approach - don't abandon high-growth sectors entirely, but maybe don't bet the farm on them either. The current landscape demands flexibility and a willingness to pivot as conditions change.