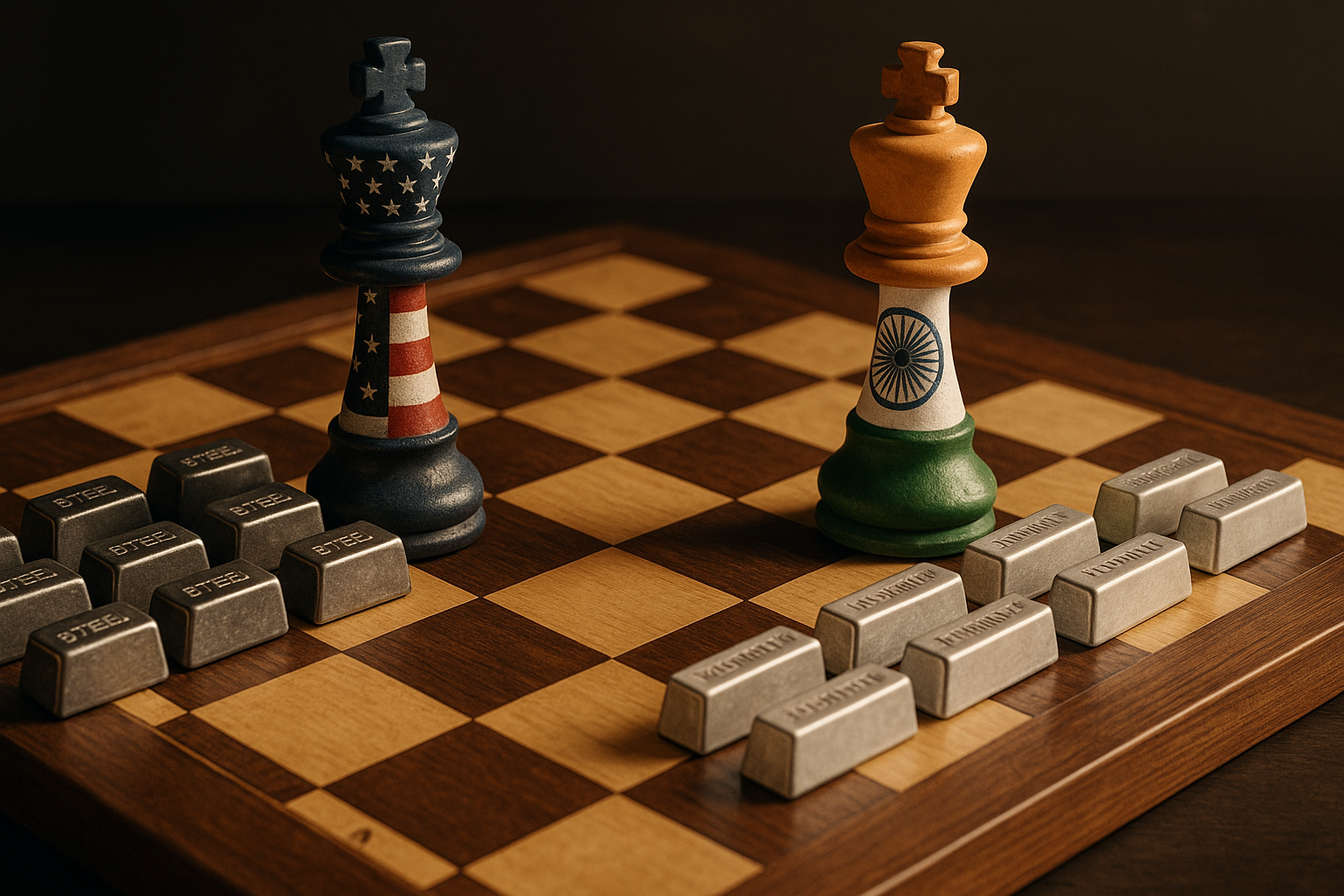

India's getting ready to play hardball in the international trade arena. According to sources close to the matter, New Delhi is preparing to slap retaliatory tariffs on American goods—a direct counterpunch to Washington's hefty 50% duties on Indian steel and aluminum imposed back in June.

The timing? Well, it's complicated.

This move comes right as Trump announced his plan for a sweeping 25% tariff on all Indian imports to the US on July 31st. But here's the thing—India insists this isn't about Trump's recent bombshell. No, no. They're framing this as a separate WTO dispute that's been simmering for months.

Does the distinction matter? In diplomatic circles, absolutely. To businesses caught in the crossfire? Not so much.

I've covered trade disputes since the early Trump years, and this follows the familiar playbook: Country A hits with tariffs (waving the magic "national security" wand that gives them WTO wiggle room), Country B asks nicely for talks, and when those go nowhere—boom—retaliation time.

"We attempted consultations, but the Americans showed little interest in meaningful engagement," one Indian official told me, speaking on condition of anonymity because they weren't authorized to discuss the matter publicly.

Let's back up a second. This whole mess actually predates Trump's recent threats. It goes back to June when the Biden administration decided to slap those 50% duties on Indian steel and aluminum. India's argument? These are just "safeguard measures in disguise," not legitimate national security actions.

The steel and aluminum trade war isn't new. It kicked off under Trump's first term in 2018, with India initially hitting back with tariffs on $1.4 billion worth of US goods—everything from almonds (hello, California farmers) to medical devices. Those countermeasures were temporarily shelved during negotiations, but now? The gloves are coming off again.

What makes this particularly fascinating is how it fits into the broader US-India relationship.

These two countries have been getting cozy on defense for years. India's bought billions in American military hardware. They've joined the Quad alliance to counter China. Strategic partners, right?

But economically? It's always been... awkward.

India's $20+ billion trade surplus with the US sticks in Washington's craw. Meanwhile, New Delhi bristles whenever the Americans lecture them about buying Russian oil—which, by the way, just triggered additional US penalties announced August 6th.

Look, the fundamental challenge here is that countries increasingly want to keep their security partnerships and economic policies in separate boxes. But that's becoming impossible. Whether it's tech restrictions, mineral supply chains, or energy security, the line between trade and national security is blurrier than ever.

For businesses caught in this mess, it's a nightmare of uncertainty. Not just the direct tariff hits, but all the secondary effects—supply chains scrambling, prices going haywire, market access becoming a question mark.

Will this spiral into a full-blown trade war between the world's largest and fifth-largest economies? History suggests restraint. India typically targets politically sensitive but economically manageable US exports (those California almonds again, plus walnuts and certain medical devices).

The reality is brutally simple: India needs the US market and American investment dollars. The US, meanwhile, increasingly sees India as the crucial counterweight to China. This underlying strategic logic—I'm told by sources in both capitals—means both sides will probably keep this dispute within bounds. Uncomfortable enough to send signals, not so damaging as to blow up the broader relationship.

So the chess match continues. Each side calculates moves several steps ahead, eyeing not just the economic board but the geopolitical one too.

The only certainty? If you're a business caught between these giants, better start planning for a fragmented international economic order. This game's far from over.