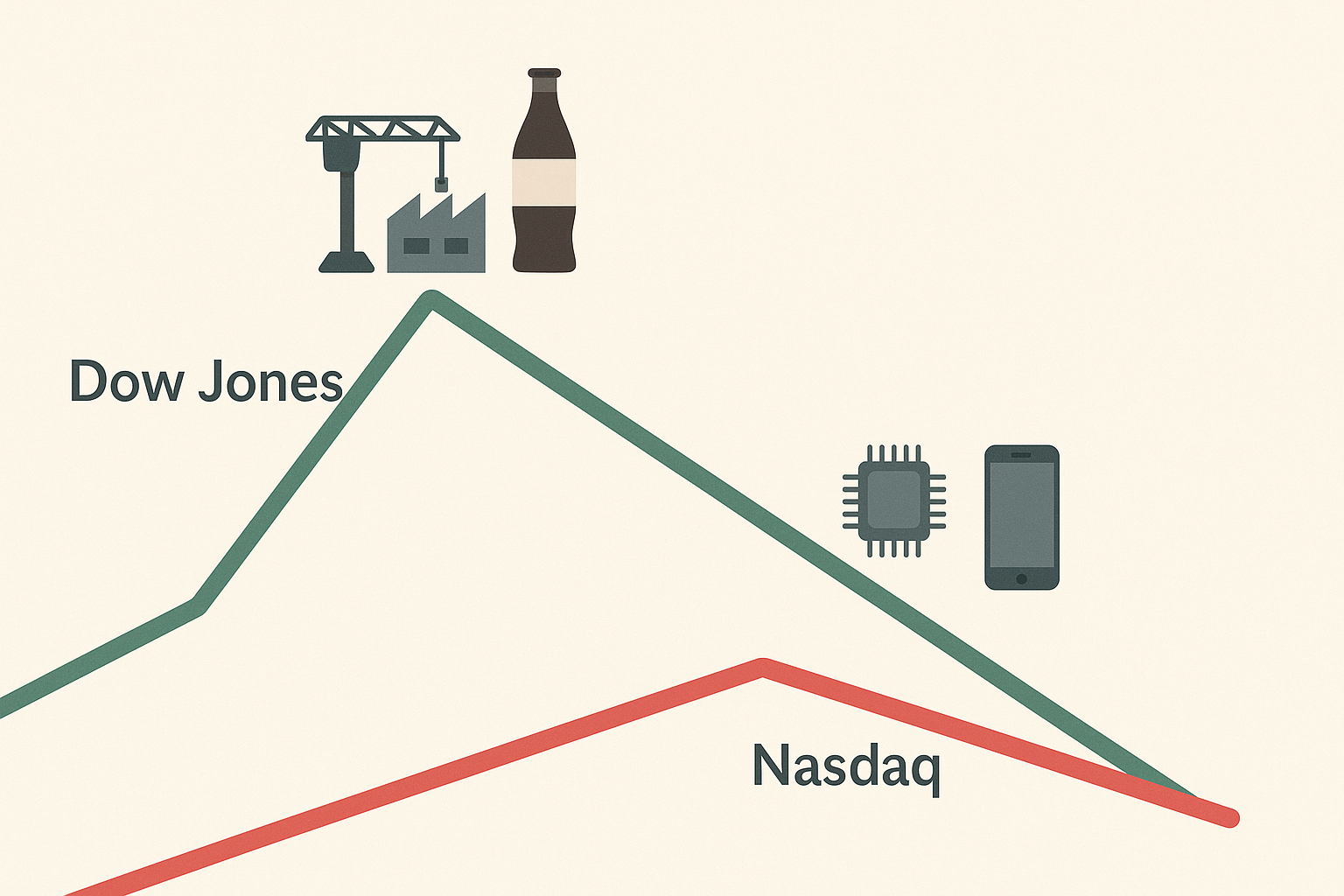

The Dow Jones Industrial Average climbed to a fresh all-time high today, even as technology stocks and the broader Nasdaq index retreated. This market divergence highlights the ongoing rotation between growth and value sectors that's characterized much of 2025's trading.

The blue-chip Dow rose 0.4% to close at 42,567, surpassing its previous record set just last week. Meanwhile, the tech-heavy Nasdaq fell 1.3%, and the S&P 500 slipped 0.7%.

"We're seeing a classic sector rotation play out," explains market strategist Carlos Ramirez. "As tech valuations have stretched and interest rate uncertainty persists, investors are finding comfort in more traditional industrial and consumer stocks."

Leading the Dow's charge were Caterpillar (+2.3%), Coca-Cola (+1.9%), and Johnson & Johnson (+1.7%) - all companies that benefit from economic stability and consumer spending resilience. These gains were enough to offset weakness in the Dow's tech components, including Apple, which fell 1.1%.

The contrast between the Dow's strength and Nasdaq's weakness reflects investor concerns about technology sector valuations after their strong run earlier this year. The semiconductor industry was particularly hard hit today, with the Philadelphia Semiconductor Index dropping 2.5% as companies like Nvidia and AMD faced selling pressure.

I've been watching this market rotation develop over the past few weeks, and it's fascinating how money seems to be shifting rather than leaving the market entirely. While some investors are taking profits in high-flying tech names, they appear to be reallocating to more value-oriented sectors rather than moving to cash.

Economic data released today provided a mixed picture. Housing starts came in below expectations, declining 3.2% in July, while industrial production rose a better-than-expected 0.5%. This divergence between housing weakness and manufacturing resilience may be contributing to the sector rotation we're seeing.

The 10-year Treasury yield ticked up to 3.87%, reflecting ongoing uncertainty about the Federal Reserve's rate path. Tomorrow's release of Fed minutes could provide additional clarity on when rate cuts might begin.

For investors trying to navigate this environment, maintaining exposure across both growth and value sectors makes sense. The market's leadership has shifted multiple times this year, and diversification has